PVR acquires SPI Cinemas: A reading between the lines

“PVR buys Sathyam Cinemas!”

Multiple Whatsapp groups are buzzing with messages about the big acquisition. Only people associated with Chennai (like me) will understand that these messages are not from sharing news from a business standpoint but due to an emotional quotient.

“What will happen to Sathyam Popcorn?!” — a question asked by everyone from my mother to a close friend. This message clearly echoes the sentiment created by Chennai’s most beloved cinema chain.

Where else will you find these sentiments?

Let’s break the topic down and see why it all adds up.

Setting the scene #

PVR Cinemas, India’s largest multiplex chain (with 638 screens) will be acquiring close to 72% of SPI Cinemas, south India’s largest cinema chain (with 76 screens) in a deal valued at INR 850 cr (over USD 122 m). SPI Cinemas owns the iconic Sathyam Cinemas in Chennai.

Occupancy rates #

SPI Cinemas has a staggeringly high occupancy rate of 58%. Anyone who understands the business of cinemas will have their eyes popping here. In comparison, PVR Cinemas has an occupancy rate of 31.3%. The global percentage is even lower.

SPI has been able to bring in audiences like no other cinema chain can imagine. Hopefully this magic will rub off on PVR.

Sathyam: The iconic brand #

SPI Cinemas, who operates across South India, started their journey with a single location in the heart of Chennai called Sathyam Cinemas (estd. 1974). In an era when other cinemas were sticking to basics without any real innovations, Sathyam thought ahead of its time to move into the multiplex space.

An outside view of Sathyam Cinemas

PVR exists in Chennai, but SPI Cinemas has managed to create brand loyalty like no other while most of the local cinemas in Chennai have either died or gone into obscurity (remember Devi Theatres?). All thanks to SPI’s forward-looking team helmed by Kiran Reddy and Swaroop Reddy, who will continue to be involved in the business.

As pointed out by an avid cinemagoer and ex-SPI Cinemas employee:

“Hmm… not sure as an avid moviegoer. No real impact unless fully rebranded. In which case, some loss of southern identity, concern about service delivery/quality of service, and commitment to overdeliver at price point. PVR has always felt assembly-line to me personally.”

As of now, it seems like PVR will be retaining the Sathyam brand, which is great news for most of us.

Sathyam Popcorn: Cinemas are in the business of hospitality #

We moviegoers, we go to cinemas to enjoy a good outing. To enjoy the larger-than-life movies along with some mouthwatering snacks. Between cinemas, there’s little differentiation between the cinematic experience itself, ie., 3D movies, Dolby Atmos sound. So why choose going to an SPI over a PVR or an INOX? The answer is simple — Sathyam Popcorn (as it’s fondly called).

Fun Fact: Sathyam Popcorn also has its own memes

(Courtesy: Food Gravy)

The cinema business is increasingly a business of hospitality and less of movie-watching itself. It is a known fact that most of a cinema’s revenues come in from its nachos and popcorn. We are all aware that popcorn costs over 70% more in cinemas than elsewhere, so why not provide the best-tasting popcorn?

SPI Cinemas caught on to this early. They worked hard on not only providing a fantastic movie experience but also superb customer service and F&B. This killer combo helped SPI rise above cinemas who charged exorbitant money for mediocre service and stale popcorn. People visit SPI cinemas blindly based on the brand, and they’re seldom let down. As mentioned earlier, 57% occupancy rates more than sufficiently prove this fact.

Here’s what Senthil Kumar, co-founder, Qube Cinema, had to say about the acquisition:

“We’ll lose some of the character, the clever original ideas, the love for quality and perfection over economics that defined Sathyam for all of us moviegoers. But hopefully some of these unique characteristics will rub off on to PVR and help improve their theatres across the country!”

So the big fear remains: Will SPI stop selling Sathyam Popcorn? #

As spoken to The Hindu by Nitin Sood, CFO of PVR Ltd:

“We decided on this deal because SPI Cinemas is one of the finest brands in the theatre industry. They understand the business and consumers very well and deliver. We will also pick up the best practices from them and will share ours…

“The food and the popcorn at SPI, which is close to every movie-goer, will remain…”.

Huge sigh of relief! :)

In South India #

The south Indian movie landscape has long been overshadowed by Bollywood and Hollywood movies, which account for 40% and 10% respectively as compared to Tamil, Telugu and Kannada movies which account for a significant 37% of the Indian box office.

A still from the blockbuster Bahubali-2

The per capita movie consumption in South India is far higher as compared with national averages. The penetration of multiplexes is only 14% in South India compared to 60% in north India. These numbers make the south Indian market highly lucrative and irresistible for PVR.

PVR Cinemas: A hungry giant #

PVR has been on an expansion spree. The company wants to reach over 1000 screens by 2020 in India and is wanting to master the art of hospitality combined with cinematic experience. They also took a $4 million stake in U.S. luxury cinema chain iPic. The main reason was to draw learnings about luxury cinemas and apply them to India. Additionally, they’re also looking at opening cinemas in the Middle East, having signed an agreement with the Dubai-based Al Futtaim group for a JV.

World’s highest admission per screen #

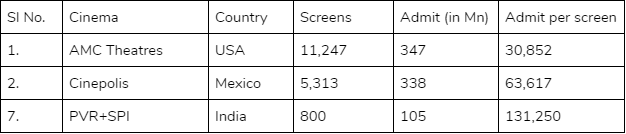

Post-acquisition, PVR becomes the world’s 7th largest multiplex player by admissions at 105 million. The largest is AMC Theatres in the US with 347 million admissions, closely followed by the Mexican Cinepolis at 338 million.

PVR does have the highest admissions per screen across the globe at 131k as against AMC Theatres at 31k and Cinepolis at 64k.

As you can see from the above statistics, the number of screens PVR has, even after the SPI acquisition, is far lesser than the top two. Ranks 3 to 6 include Cinemark (USA), Wanda (China), Regal Cinemas (USA) and CGV (S. Korea).

PVR + SPI: A step in the right direction #

All in all, we believe this acquisition is a step in the right direction. Fortunately, PVR will not be changing the cherished DNA of SPI cinemas — which evokes a big sigh of relief. And we are actually happy that PVR is willing to learn from the smaller players, be they SPI or iPic, to create a FUNtastic atmosphere for the audience.

Yes, a bit of an emotional send off for Sathyam, but we know that it’s for the best. South India needs more multiplexes and cinema penetration in general. PVR has the legs to pull that off.

Tushar Dhingra, ex COO of Big Cinemas and ex CMO of PVR Cinemas notes:

“Clearly, it consolidates their leadership position. And they will be able to extract more value from these combined assets. Their advertising and F&B revenues will pick up further. Their growth path for south India obviously adds value. Their being leaders and present in Delhi, Bombay, Pune, Chennai, Bangalore, (and) Hyderabad, which are the top markets in India, will only add value to them.

“Keeping Sathyam management involved in the overall business will make sure that the complexities of south Indian states will be handled very well. And there are CP’s against a 100-crore value which is again a very smart move. It is very well structured, I think. It’s forward-looking and makes absolute sense.”

We’re Influx #

Influx is a digital technology company which specialises in working with cinemas. We build websites, mobile apps, kiosks and other modules over your existing ticketing platforms. Our origins are in Chennai (+ offices in Dubai and Dallas, TX) and have worked with over 21 cinema chains including PVR and SPI Cinemas. We’re constantly thinking about how to help cinemas sell more tickets and improve the guest experience.

Our motto: Let’s Make Cinema’s Great Again :).

PS: We’re hoping people in India can taste the oh-so-good Sathyam Popcorn and relish it with A.R. Rahman music at a PVR near you. No one can eat just one. ;)

Amit Mehta is Business Head at Influx, and based in Dubai. With over twelve years of marketing and business-development experience across Europe, Middle East and India, Amit manages market growth of global cinemas for Influx. Touch base with him for a chat about movies, tech, and unicorns.